23 Jul Bitcoin, Cryptocurrencies, and Distributed Ledger Technology

If you read financial news, you may have noticed a mention or two-or many-of Bitcoin. Because of its parabolic rise in price in 2017, there is much hype and interest in the Bitcoin/Cryptocurrency space. Nonetheless, many people do not fully understand how the technology works. This short essay will attempt to give you a basic understanding of the topic.

What is Bitcoin?

Bitcoin is a new, decentralized currency that was created in 2009 by an unknown person using the alias Satoshi Nakamoto. It is a fiat currency like other fiat currencies, but it has no attachment to a country, national economy or central bank. Unlike nationally issued currencies, Bitcoin has no paper form and only exists and transacts electronically. Bitcoin is a “cryptocurrency” (digital currency), and there are several others (hundreds, actually). Some of the other, better-known cryptocurrencies are Ethereum, Litecoin and Ripple.

Understanding Cryptocurrencies

One of the ways to understand Bitcoin and other cryptocurrencies is to think about how your bank records your digital transactions. Today, we pay for most goods and services using a debit card. This transaction, like Bitcoin transactions, happens digitally. To accomplish this digital transaction, Bank B receives the order from the credit card processor, which received the order from the merchant. Bank B sends an order to bank A to place a debit on your account for the amount of your purchase. Bank A verifies you have the funds and sends those funds to bank B. Bank B credits the merchant’s account. In this situation, there are numerous parties and counterparties involved. Everyone trusts the system because all the intermediaries involved are regulated and insured.

In a Bitcoin transaction, unlike in a bank, all the information regarding currency ownership is held on a “distributed ledger,” copies of which are stored by thousands of computers. All of these copies are identical, encrypted and unchangeable unless certain conditions are met. The system is trusted for transactions because of the encrypted nature of the ledger, the process by which information is added and because anyone can verify transactions for themselves. Anonymity is assured because the ledger consists of account keys (think account numbers) without names attached.

Each Bitcoin holder stores his/her currency in an electronic account called a wallet. A cryptocurrency wallet can be held online, a hard drive, a USB storage drive or on other electronic storage mediums. When a person wants to make a transaction, they direct an electronic wallet to send funds to another account. The receiving account provides the sender with the recipient’s address. While anyone can see what information is on the distributed ledger, only someone with access to the wallet can initiate a transaction.

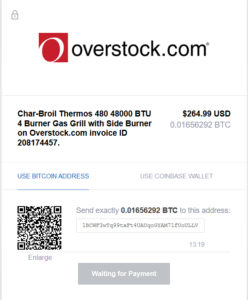

A Bitcoin transaction, unlike a debit card transaction, happens without any formal intermediary. Assume you want to purchase an item from Overstock.com. At checkout, you choose to pay for the item via Bitcoin, and you get the following notification.

This is a hypothetical example for illustration purposes only and does not represent an actual investment or transaction.

Overstock provides their wallet address and you electronically instruct your wallet to transfer the funds to that address. This is similar to a bank transfer where you initiate electronic instructions to move funds. Once Overstock receives the Bitcoin, they can hold it or exchange it for other cryptocurrencies or even for dollars, euros or other centralized currencies. All of this happens without a bank, credit card processor or other intermediary. The transaction settles immediately, so there is no wait time for verification other than the few minutes it takes for electronic signals to go from one participant to the other. Theoretically, this should make the transaction much more efficient.

Overstock provides their wallet address and you electronically instruct your wallet to transfer the funds to that address. This is similar to a bank transfer where you initiate electronic instructions to move funds. Once Overstock receives the Bitcoin, they can hold it or exchange it for other cryptocurrencies or even for dollars, euros or other centralized currencies. All of this happens without a bank, credit card processor or other intermediary. The transaction settles immediately, so there is no wait time for verification other than the few minutes it takes for electronic signals to go from one participant to the other. Theoretically, this should make the transaction much more efficient.

Because there is no bank or other financial intermediary, you might wonder how the transaction request gets processed. Enter miners. Miners are computer owners who have set up computers and equipment to process cryptocurrency transactions. Like a teller at a bank, a cryptocurrency miner verifies account information (electronically) and records the transaction on the distributed ledger. Also like a bank employee, a miner does his/her job for pay. Miners are rewarded small amounts of cryptocurrencies for processing the transactions. Sometimes this process is very profitable, and sometimes it is not. The mining process is complex and I won’t get into the nuances of it. Just know that miners show up for work because they make money doing so. As long as the cryptocurrency ecosystem is profitable, miners will continue to process transactions.

A Dark History

The Overstock.com example is a fairly easy-to-grasp example of good, wholesome capitalism at work where two free market participants enter into an exchange. However, the beginning of Bitcoin was not so wholesome, and much of the cryptocurrency space is still dominated by seedy participants. Human traffickers, drug dealers, prostitutes and money launderers used Bitcoin because of ease of payment and anonymity. Drug dealer A no longer had to meet drug supplier B in a dark alley with a briefcase full of cash. Instead, he could pay him over an anonymous, unregulated system. As you would imagine, this stoked the interest of black market participants and organized crime.

While mainstream participants are beginning to funnel in, most of the United States public remains unaware of what cryptocurrencies are. As awareness grows and capital flows follow, we may see additional upside in many of the currencies offered. However, many early adopters are now sitting on huge gains and may cash out as Mom and Pop begin to trickle in. Without assets, cash flows, verifiable balance sheets, regulatory oversight and legal equity, there is no way to assign a fair value to cryptocurrencies.

What Are the Risks?

Cryptocurrencies and Initial Coin Offerings (ICOs) are not stocks. By owning them, you do not have any legal equity stake in the company that is making the offering. All you own is a currency that is issued based on an idea. Some ideas are good and some are bad, but almost none of the companies offering ICOs have a business plan that shows how the company will be able to monetize their idea. There is also no regulatory oversight, so we don’t know who is being honest and who isn’t. As a fiduciary, I cannot recommend any of the ICOs, as I cannot fulfill my fiduciary standards in doing so.

That said, the gains made in the space are going to be too much for some people to resist. If they do choose to participate, I advise them to use small amounts of money that would not materially change their lifestyle if completely lost. I also show them the chart of the parabolic move in the NASDAQ prior to the dot-com bust. Sober thought needs to reign here. While the gains are attractive, the idea that this space will mature without some setback is an unrealistic one.

Our office is paying close attention to developments in the distributed ledger/blockchain space. We are looking for and researching established, legal companies using the technology to improve their processes, enhance earnings and bring efficiencies. Said another way, we are looking for leading-edge companies successfully monetizing the technology. While doing so, we are keeping in mind that a large number of internet companies that existed in the 1990s went broke and no longer exist. While we think the technology will be world-changing to some extent, we are sober-minded enough to know there will be many losers and a few winners. The winners, however, could be very exciting.

Our Outlook

As stated above, we are watching closely as the space matures. To sum it up, we know of no rational way to value the actual currencies that are traded. We further believe, however, that the distributed ledger technology could be very useful and may even be world-changing. This would be not only from a payments and remittances standpoint, but also from a corporate asset management, human resource and supply chain standpoint.

While the internet has so far been primarily the internet of ideas and information, distributed ledger technology could be the “internet of things,” so to speak. Distributed ledger technology could allow us to control and move assets with reduced audit burden, instant verification, and instant title transfer. Imagine being able to move a large corporate asset to a new owner whereby payment and ownership transfer happen simultaneously through the use of a smart contract. All of which could be accomplished without expensive legal documents or intermediaries to ensure trust. These ideas are theoretical at the moment, but they may come to pass. If they do manifest, they will come with great opportunity to those who see and embrace the change.

Opinions expressed in the attached article are those of the author and are not necessarily those of Raymond James. All opinions are as of this date and are subject to change without notice. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information, developed by an independent third party, has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. This information is not intended as a solicitation or an offer to buy or sell any security referred to herein. Investments mentioned may not be suitable for all investors. Expressions of opinion are as of this date and are subject to change without notice. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Prior to making an investment decision, please consult with your financial advisor about your individual situation. The prominent underlying risk of using bitcoin as a medium of exchange is that it is not authorized or regulated by any central bank. Bitcoin issuers are not registered with the SEC, and the bitcoin marketplace is currently unregulated. Bitcoin and other cryptocurrencies are a very speculative investment and involves a high degree of risk. Investors must have the financial ability, sophistication/experience and willingness to bear the risks of an investment, and a potential total loss of their investment. Securities that have been classified as Bitcoin-related cannot be purchased or deposited in Raymond James client accounts. Prior to making an investment decision, please consult with your financial advisor about your individual situation.